Cybersecurity & cyber insurance = protection, and protection for your protection

Key Takeaways:

- Know what cybersecurity insurance is.

- Understand the value of cybersecurity insurance.

- A collection of eye-opening facts that relate to businesses of all sizes.

- The importance of creating a Cybersecurity checklist for your business.

- How to ensure your existing cybersecurity policies are rock solid.

Cybersecurity is a scary hot topic right now. (CEO entrepreneurial types, can you feel us?) One of our top company values is “Be the Answer.” So, we hope this article provides you with some answers to those burning questions that might be keeping you up at night.

Cyber attacks are big business and a big deal – especially for small and medium-sized enterprises that can’t take the financial hit. Cyber-attacks continue because they make money. The World Economic Forum (WEF) claims cybercrime has grown to become the world’s third-largest economy after the US and China.

There isn’t anybody anywhere in the world who isn’t at risk of severe financial loss from a failed cybersecurity strategy. Attacks occur 24/7/365, often starting with something as simple as a phishing email. (Phishing emails – jeez – shouldn’t we know better by now? Apparently not.)

Consider these cybersecurity facts:

- 48% of businesses have reported experiencing a phishing attack (that’s only the ones who reported it).

- Small businesses are the target for between 40-70% of cyber-attacks. Why the range? Not all cyber-attacks are reported.

- Cybersecurity professionals aren’t a dime a dozen – there’s an expected shortage of 3.5 million cybersecurity professionals.

- The average cost of a successful ransomware attack is now $11.5 million.

- 60% of businesses close within 6 months of a cyber-attack. BAM!

In a business environment that’s under constant threat of cybercrime, this guide spells out why you need to seriously consider comprehensive cyber insurance protection.

What the phish is cyber insurance?

Cyber insurance is liability insurance for safeguarding business operations in the event of a cybersecurity attack. Like most insurance, cyber insurance provides a layer of financial protection against ransomware, data breaches, and other cyber-attacks. Think CYA.

A quality, comprehensive cyber insurance policy typically provides coverage for:

- Network security breaches

- Data loss

- Network downtime and repair

- Hardware/software damage

- Litigation

- Regulatory penalties for data loss

- Security management costs

Is cyber insurance worth the cost? Remember 60% of businesses fail after a successful cyber-attack. Why? Financial losses from litigation, regulatory compliance fines, and a significant loss of customer trust and brand reputation. Cyber insurance may be the lifeline your business requires to be able to continue should your cybersecurity strategy fail.

What if my business already has a cybersecurity strategy?

Congrats! You’re already ahead of the game that too many businesses struggle to invest in despite the potential for a security disaster. A cybersecurity strategy and plan help a business safeguard digital assets, including networks and sensitive data. A strong cybersecurity strategy identifies potential risks and implements structured controls and continuous security monitoring. A cyber security implementation plan is a roadmap that outlines the measures you should take to be more certain of that.

Do you understand precisely how your business’s networks, hardware, software, data, APIs, and third-party integration function? Do you understand where each of those is vulnerable to attack? Now, think about how often systems, databases, and devices must be updated for security patches. Security patches come out constantly because cybercrimes’ variety, type, and complexity continue to evolve, so security becomes an area of constant change.

Not only do your systems need to be kept up to date, but so must your employees. Security training is not a one-and-done deal; it’s continuous. After all, the one vulnerability that’s hardest to control completely – is a human.

Remember that your cybersecurity strategy also requires a team that manages a security incident when it occurs. That team must be kept up to date and be prepared for immediate action. Disaster recovery may make the difference between a business closing or thriving during and after a cyber-attack. Many companies simply hope they don’t get to that point. But hope is not a strategy. Wouldn’t a cyber insurance plan come in handy to help with expenses if a security incident did impact your business?

SO… How do you get started with cyber insurance? Start by creating a cyber insurance coverage checklist. Why? A checklist helps identify and prioritize your needs based on your unique business, industry, and IT infrastructure architecture. Again, “Be the Answer.”

What’s the value of creating a cyber insurance coverage checklist?

Creating a cyber insurance coverage checklist allows businesses to identify what they need based on anticipated security risks. You want to get exactly the coverage you need, not more and certainly not less. There’s no sense in investing in an insurance policy if it doesn’t return the favor.

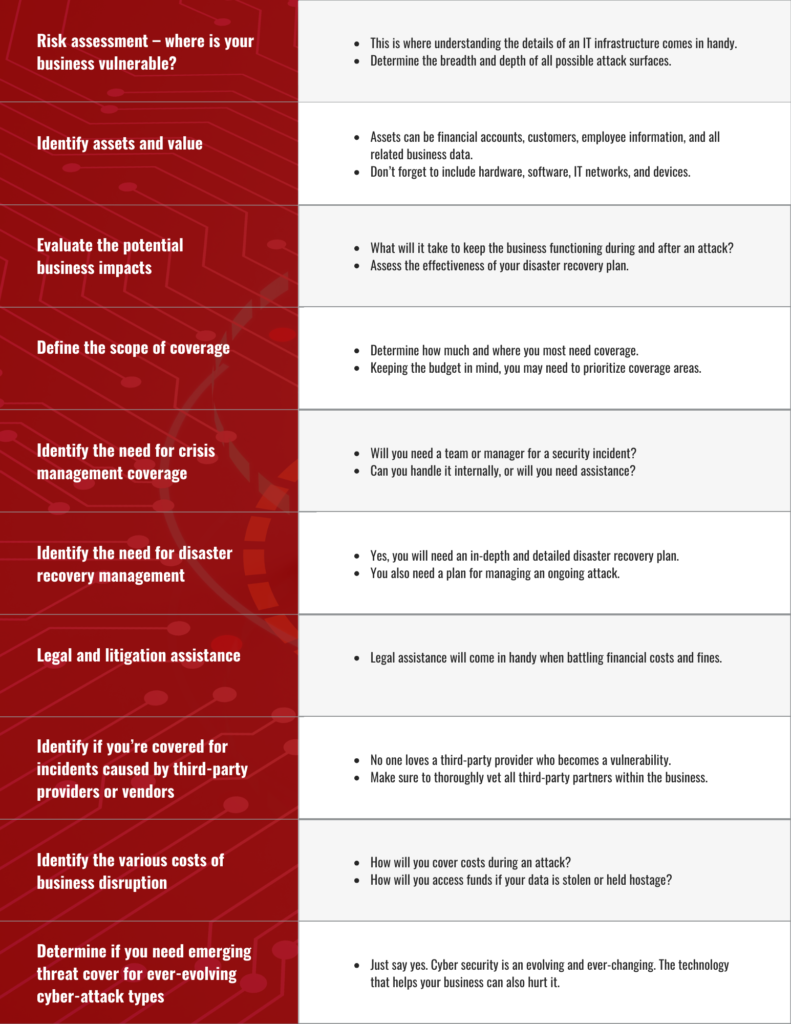

A cyber insurance coverage checklist typically includes:

Cyber insurance AND a proactive MSP partner to help

Attentus is an MSP that’s all about providing answers to our customers. Every employee operates with a key core value to “Be the answer.” You need answers when tackling thorny issues like cybersecurity strategies and cyber insurance. A full-service MSP provider, Attentus helps clients by delivering and monitoring services that meet the requirements for your cybersecurity insurance coverage.

Your business is unique, and so are your security and cyber insurance needs. Find an MSP partner that’s more than simply a service provider. An MSP like Attentus is an active partner in your business growth and success. Attentus is a leading provider of IT services in the Seattle area. Make your IT management simple, exceptionally effective, but not scary. Leave the mismanaged security incidents in the rearview mirror and partner with Attentus today. Straightforward pricing and an accurate price quote in 30 minutes. Do you know how rare it is to be able to get that kind of quote? Just 30 minutes, and you’ve got your answer.